Closing cost calculator paying cash

What are closing costs. This refinance closing cost calculator helps you estimate your fees and costs so youll have an idea of what you can expect to pay.

Closing Costs Associated With Real Estate Cash Offers Accept Inc

The slider starts in the red indicating that the closing costs exceed the interest savings at first.

. Instead of paying taxes on a 50000 gain you would only pay taxes on a 45000 gain. The third tab shows current Redmond mortgage rates to help you estimate payments and find a local lender. Because your mortgage interest.

The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. In 2010 one survey estimated that the average total closing cost United States on a 200000 house was 3741. Even if youre buying a home with cash the one-time closing costs or fees youll have to pay during the closing process can be as much as 3 of the purchase price according to Lee Dworshak.

If youre paying out more in closing costs you wont actually benefit from refinancing. In the event that you decide to pay off your loan balance in full within 36 months after your loan closes you will be required to reimburse Discover for some of the closing costs that we are paying on your behalf not to exceed 50000. By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan.

Cash-out refinancing can help homeowners who want to consolidate high-interest debt. Alternatively you can pay your closing costs in cash similar to your down payment. Whether youre a first-time homebuyer or have purchased property before if you get a mortgage to buy a home youll have to pay closing costs.

Total Closing Costs 12350. Calculate your down payment. However it means you wont have to pay.

When you consider whether points are right for you it helps to run the numbers. You can generally expect the total to be between 1 and 5 of the price you are paying to buy your home. Prime Rate the London Interbank Offered Rate LIBOR and the Treasury Index T-Bill.

The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates. For example paying off a mortgage with a 4 interest rate when a person could potentially make 10 or more by instead investing that money can be a significant opportunity cost. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing.

A guide to better understanding closing. Discover Home Loans pays all closing costs incurred during the loan process so that you dont have to bring any cash to your loan closing. Mortgage closing costs are the fees you pay when you secure a loan either when buying a property or refinancing.

Some loans require a 20 down payment while others will allow you to put down much less. If youre low on cash consider a no-closing-cost refinance. Determine whether you have the cash available to buy points up front in addition to your down payment closing costs and reserves.

Cities and determine if you will be able to maintain your current standard of living in another city. The name is a bit deceiving as this isnt free. Our closing cost calculator estimates your total closing costs if you are buying a house.

The calculator includes interest paid plus the estimated closing costs. You should expect to pay between 2 and 5 of your propertys purchase price in. Shop around for a loan that will work well with the amount of money you have to put down.

This will be determined by how much money you have to put down and what kind of loan you get. Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. Consider a no-closing cost refinance.

For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. Payment for closing costs can sometimes be financed with your loan in which case it will be subject to interest charges. Closing costs also known as settlement costs are the fees you pay when obtaining your loan.

Common indices in the US. Your lender can help you decide whether paying points is right for you. No-closing-cost mortgages are still a suitable.

If you paid 5000 in transfer taxes when you purchased the home you could deduct that along with the other costs you incurred associated with the home collectively known as the cost basis to reduce the taxes you owe on the sale. These fees paid to third parties to help. Use this cost of living calculator to compare the cost of living between US.

While each loan situation is different most closing costs typically fall into four categories. Total Cash Amount Required at Closing 92350 12350 Total Closing Costs 80000 Down Payment. Capital locked up in the house Money put into the house is cash that the borrower cannot spend elsewhere.

This means that you will be paying more interest over time. Other indices are in use but are less popular. What is included in closing costs.

Refinancing is not the only way to decrease the term of your mortgage. Also consider how long you plan to own the home.

Closing Costs Calculator How Much Are Closing Costs Nerdwallet

Closing Costs Explained How Much Are Closing Costs Zillow

Cash To Close What You Need To Know First Heritage Mortgage

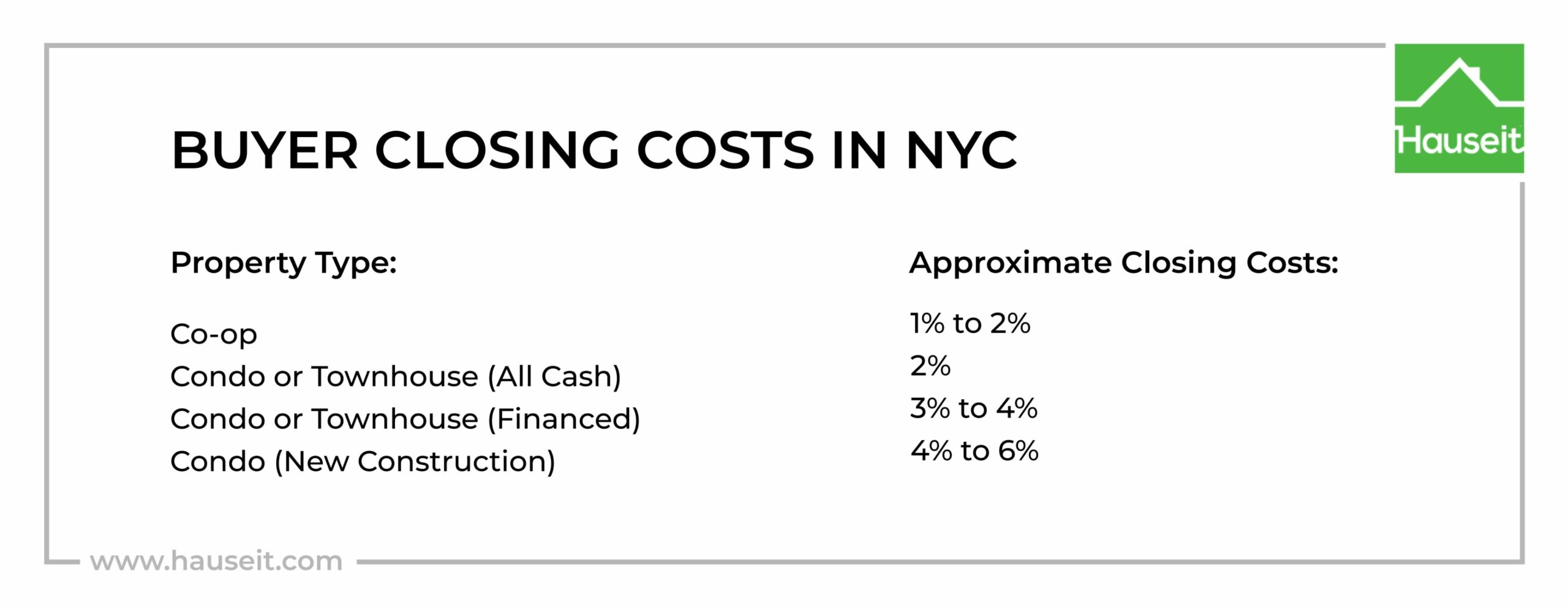

Nyc Buyer Closing Cost Calculator Interactive Hauseit

What Is A Loan Estimate How To Read And What To Look For

Fha Loan Closing Cost Calculator

Closing Costs Calculator Credit Karma

Nyc Buyer Closing Cost Calculator Interactive Hauseit

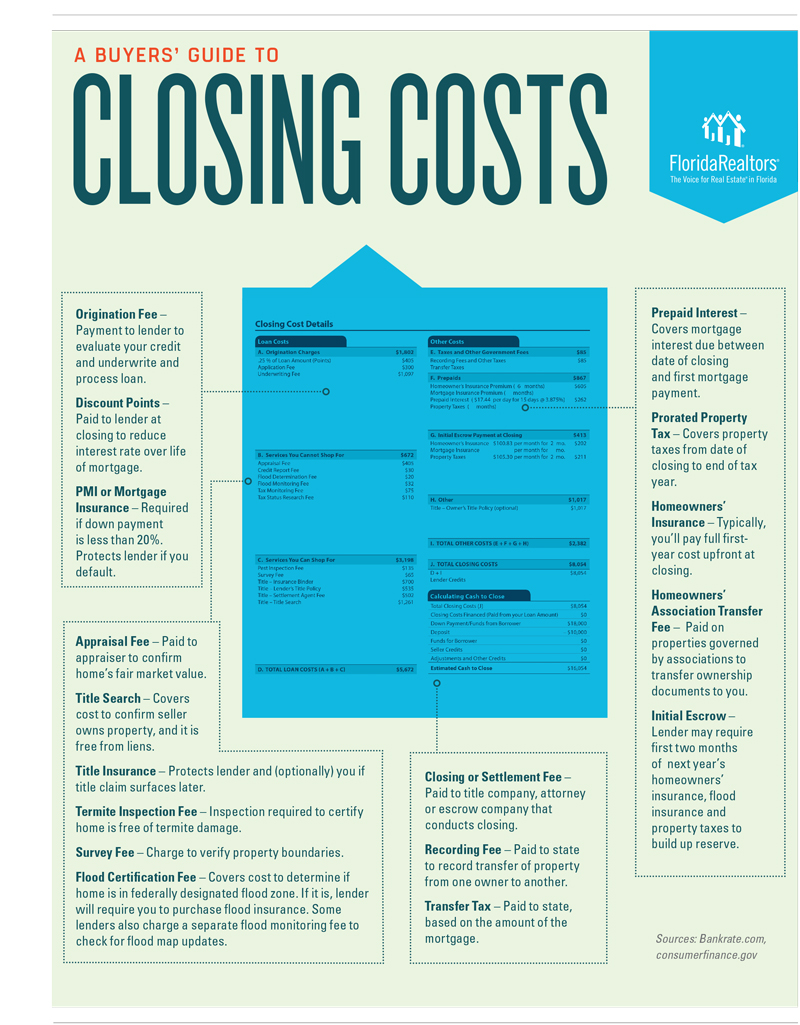

The Buyers Guide To Closing Costs Florida Realtors

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Can A Seller Refuse To Pay Closing Costs

Home Buyers Closing Cost Calculator Mls Mortgage Closing Costs Mortgage Home Loans

Closing Cost Calculator For Buyers All 50 States 2022 Casaplorer

What Are The Closing Costs When Selling A House In New York

Closing Costs When Paying Cash For A Property Financial Samurai

How To Calculate Closing Costs On A Nc Home Real Estate